Take note that closing entries are prepared only for temporary accounts. Our AI-powered Anomaly Management Software helps accounting professionals identify and rectify potential ‘Errors and Omissions’ throughout the financial period so that teams can avoid the month-end rush. The AI algorithm continuously learns through a feedback loop which, in turn, reduces false anomalies. We empower accounting teams to work more efficiently, accurately, and collaboratively, enabling them to add greater value to their organizations’ accounting processes.

What is the approximate value of your cash savings and other investments?

Calculating the income summary for a month, quarter or year is surprisingly easy. Income summary entries provide a paper trail when auditors go over your financial statements. This means that in order to close a revenue account at the end of a financial year, a debit entry needs to be created with the balance of the revenue accounts. The other side of the entry (credit) goes to the income summary account. After preparing the closing entries above, Service Revenue will now be zero.

Which of these is most important for your financial advisor to have?

- Our AI-powered Anomaly Management Software helps accounting professionals identify and rectify potential ‘Errors and Omissions’ throughout the financial period so that teams can avoid the month-end rush.

- An Income Statement is a financial statement that shows the revenues and expenses of a company over a specific accounting period.

- Thus, shifting revenue out of the income statement means debiting the revenue account for the total amount of revenue recorded in the period, and crediting the income summary account.

- To close the income summary account, the balance in the account needs to be transferred to a capital account (generally the retained earnings).

- Post the transactions to the income summary account and close the income summary account.

Directors and executives are also provided a clear picture of the performance of the company as a whole during a specific accounting period. An income statement shows how effective the strategies set by the management at the beginning of an accounting period are. It is also known as the profit and loss (P&L) statement, where profit or loss is determined by subtracting all expenses from the revenues of a company. It may be assumed that the income summary normal balance is on the credit side as this refers that the company expects the net income at the end of the period, in which it usually does expect that. However, if we base our opinion on this, it is arguable that the new company that usually expects the loss at the beginning years would assume that the income summary normal balance is on the debit side instead.

Income Summary Journal Entry

Explore professional resume, cv, cover letter templates, expert tips, and easy-to-use tools to build your perfect resume and boost your job search success. Consider seeking income summary example feedback from career advisors, mentors, or professionals in your industry to improve your resume further. Regularly update your resume with new experiences, skills, and accomplishments to reflect your most current qualifications. Emphasize transferable skills that are relevant to the job you’re applying for, such as communication, problem-solving, and leadership skills. Include essential sections such as contact information, professional summary or objective, work experience, education, skills, and relevant certifications. A Financial Analyst Resume Summary should be concise, ideally between 2 to 4 sentences.

- Take note that closing entries are prepared only for temporary accounts.

- Additionally, it is important to note that the income summary account plays both roles of the debit and the credit at the same time when the company closes the income statement at the end of the period.

- If this is the case, then this temporary dividends account needs to be closed at the end of the period to the capital account, Retained Earnings.

- As you can see, the income and expense accounts are transferred to the income summary account.

- Once the temporary accounts have all been closed and balances have been transferred to the income summary account, the income summary account balance is transferred to the capital account or retained earnings.

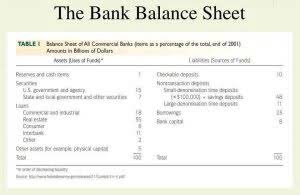

While an Income statement is vital for the business, it should be noted that an Income statement is just one of the three financial statements. Financial institutions or lenders demand the income statement of a company before they release any loan or credit to the business. Typically, investors prefer looking at a company’s operating profit figure rather than a company’s bottom line as it gives them a better idea of how much money the company is making from its core operations. This represents the profit that a company has earned for the period, after taking into account all expenses. EBT, also referred to as pre-tax income, measures a company’s profitability before income taxes are accounted for. It shows whether a company has made a profit or loss during that period.

- It is a temporary account used to summarize revenues and expenses before transferring the net income or net loss to the retained earnings account on the balance sheet.

- Instead of sending a single account balance, it summarizes all the ledger balances in one value.

- Tailor it to reflect your understanding of the industry and the specific role you’re applying for.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- It is used when a company chooses to transfer the balance of individual revenue and expense accounts directly to retained earnings.

For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C). For corporations, Income Summary is closed entirely to „Retained Earnings”. Now for this step, we need to get the balance of the Income Summary CARES Act account. In step 1, we credited it for $9,850 and debited it in step 2 for $8,790. EBITDA is not normally included in the income statement of a company because it is not a metric accepted by Generally Accepted Accounting Principles (GAAP) as a measure of financial performance.

However, EBITDA can be calculated using the information from the income statement. Income statements are important because they show the overall profitability of a company and help investors evaluate a company’s financial performance. Income statements can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus. It provides insights into a company’s overall profitability and helps investors evaluate a company’s financial performance. The single-step income statement lumps together all of XYZ Corporation’s revenues and gains and these amounted to $94,000.

How confident are you in your long term financial plan?

Conversely, if the income summary account has a net debit balance i.e. when the sum of the debit side is greater than the sum of the credit side, it represents a net loss. To close a revenue account, debit the revenue account for its balance and credit the income summary account with the same amount, consolidating the revenue for the period. This step ensures that the revenue is accurately transferred and the account is reset for the next period. If the company profits for the year, the retained earnings will come on the debit side of the income summary account. Conversely, if the company bears a loss in the year, it comes on the credit side of the income summary account. The income summary is a temporary account where all the temporary accounts, such as revenues and expenses, are recorded.